CGX and Frontera have secured contract extension until February 2022 to spud Makarapan-1 exploration well

Canadian players CGX Energy and Frontera Energy have secured an additional year to start drilling operations at the shallow-water Demerara block offshore Guyana.

Frontera said the joint venture recently completed negotiations with the Guyanese government regarding rescheduling work commitments at Demerara, with the deadline for drilling in the petroleum prospecting licence now extended until February 2022.

Prospects in sight

The partners have mapped the Makarapan-1 prospect to be drilled in Demerara and, although a proper timeline has yet to be announced, the new contract extension suggests the campaign could take place by early next year.

“The joint venture continues to advance its preparatory work for the Makarapan-1 exploration well, an Aptian stratigraphic prospect on the block,” said Frontera.

“Additional prospects and leads on the block have been identified and are being matured by the joint venture.”

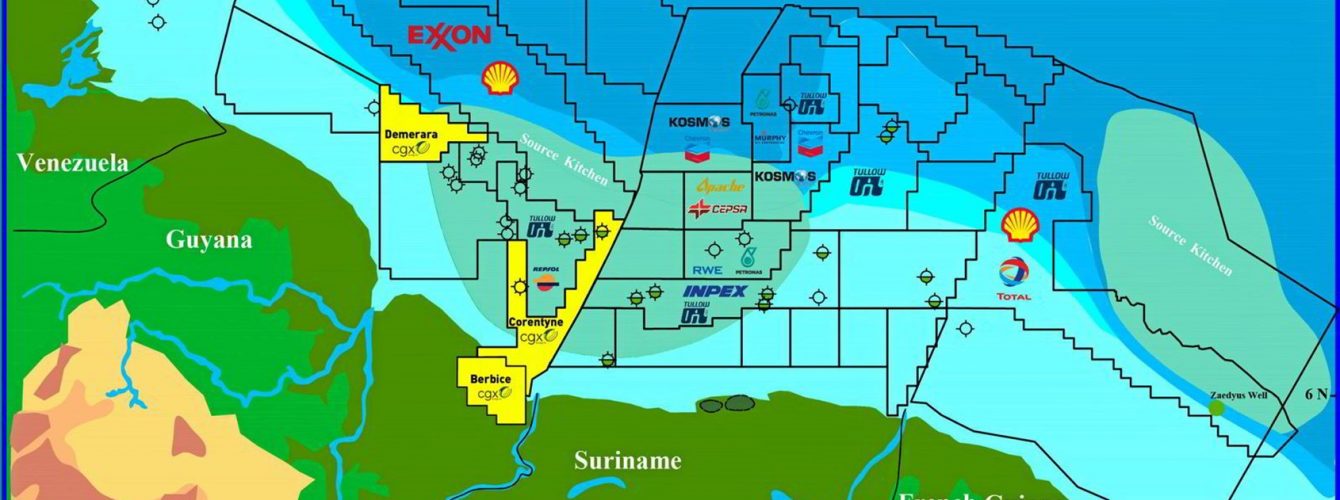

Demerara is located to the west of the prolific Stabroek block, where US supermajor ExxonMobil and its partners Hess and CNOOC International so far made 18 discoveries and unlocked recoverable volumes of about 9 billion barrels of oil equivalent.

Demerara is also adjacent to the Orinduik block. Back in mid-2019, Anglo-Irish independent Tullow Oil hit hydrocarbons at a pair of wells — Jethro-Lobe and Joe — but the finds proved to be heavy crude and would be potentially difficult to develop.

Drilling plans

CGX and Frontera are preparing to start drilling operations off Guyana in the second half. The duo is looking to spud the Kawa-1 wildcat in water depths of approximately 305 metres in the Corentyne block.

CGX had an agreement in the past with US-based driller Valaris to use the jack-up rig JUS-117 in the programme, but it remains unclear if that unit will be used to spud Kawa-1.

Frontera also hired independent firm McDaniel & Associates to conduct a resource evaluation of the two blocks.

A total of 32 prospects were identified, including 27 in Corentyne and five in Demerara, resulting in total prospective risked resources of 1.09 billion boe corresponding to Frontera’s interest.

CGX operates both Demerara and Corentyne with 66.67% stakes and Frontera holds the remaining 33.33%.

However, Frontera is also the largest shareholder at CGX with a 73.8% ownership of the company, leading to a consolidated interest of 82.6% in the Demerara and Corentyne blocks.

—

Source: Upstream | This text was excerpted from the media outlet cited on February 18, 2021 and is provided to Noia members for information purposes only. Any opinion expressed therein is neither attributable to nor endorsed by Noia.