Norwegian operator adds wells to suspended Canadian project, and indicates project sanction is a possibility for 2021

Norway’s Equinor has fleshed out plans for a beefed-up, 40-well subsea production system at its suspended Bay du Nord project off Canada and indicated a final investment decision on the US$5 billion scheme could come as early as 2021.

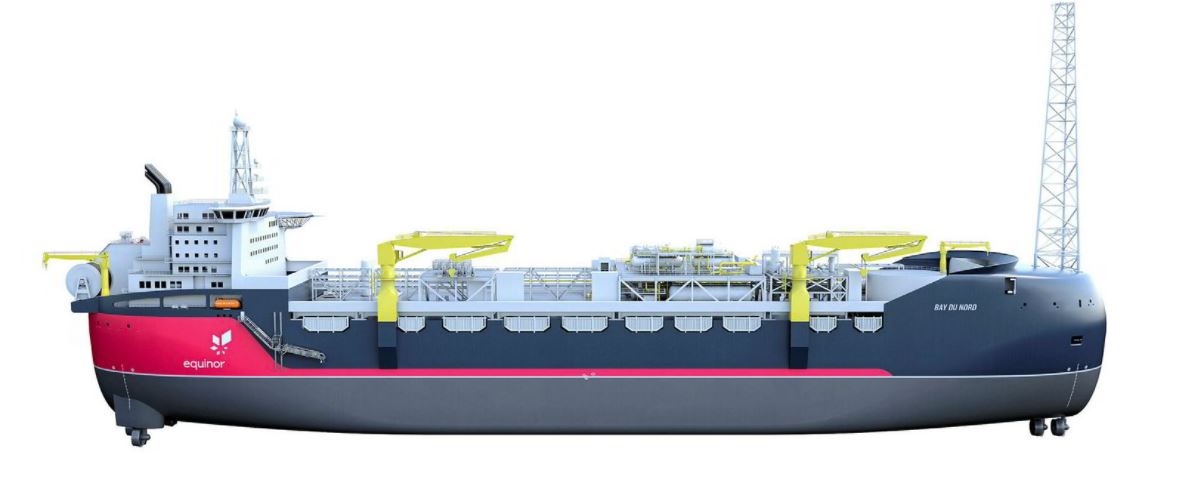

The revamped plan also highlights how Bay du Nord’s floating production, storage and offloading vessel in the deep-water Flemish Pass could host satellite discoveries.

This fresh project information is littered among 2069 pages of Bay du Nord’s environmental impact statement (EIS) and another 1100 pages of appendices that Equinor published on 30 July and which are open to comment until 13 September.

Equinor and its Canadian partner Husky Energy suspended the project off Newfoundland & Labrador in March when oil prices collapsed, just as they were ready to receive final commercial offers for the FPSO and integrated subsea packages.

A source familiar with Bay du Nord told Upstream this week that Equinor and its shortlisted bidders are “keeping the project warm” with low-level communications.

This well-placed contact expects Equinor to decide on its next steps “within the next few months,” stressing that the operator “seems confident” about the development, although the timing “is a bit uncertain at this stage”.

An Equinor spokesman said: “The current industry context means it’s even more important to have a robust business case — the project needs to be competitive in our global portfolio and reducing cost is an important part of our work.”

When Bay du Nord was suspended, only two groups were battling to provide the minimally manned FPSO: Norway’s Aker Solutions and Kvaerner had teamed up with South Korea’s Samsung Heavy Industries; while UK-based Wood and Kiewit of the US had linked up with Daewoo Shipbuilding & Marine Engineering.

One source told Upstream the rivals had submitted indicative prices to Equinor when the project went into lockdown, but have had little communication since.

TechnipFMC and a team of OneSubsea-Subsea 7 were the only two contenders in the race to land an integrated subsea contract, while Advanced Production & Loading was set to be awarded a contract to build the FPSO’s turret.

Making money from a 300-million-barrel field located some 500 kilometres from shore in 1200 metres of iceberg-prone waters was always going to be a challenge, so pausing the bid processes five months ago made sense.

Equinor said at the time that it would improve the project’s business case and assess how long to defer the development.

The operator appears to have made progress on both these issues.

Originally, Equinor aimed to take a final investment decision on what it calls the Core Bay du Nord project this year and produce first oil in 2025.

Now, according to the EIS, the “earliest possible” date for first oil is 2026, which suggests the project could be sanctioned in 2021, leading to the start of drilling in 2022 and offshore construction in 2023.

However, an Equinor spokesman cautioned: “The date denoted in the EIS is the earliest possible start date from a technical perspective. The EIS notes the project schedule has not been finalised.”

Equinor has also managed to boost the project’s resource base by finding additional oil near Bay du Nord.

Upstream reported in June that the Cappahayden wildcat hit oil in licence 1126 and Equinor was already working on plans to exploit this find as a subsea tieback to the FPSO.

Equinor is now drilling its Cambriol probe in the same licence, after which the rig will return to Cappahayden to carry out further tests.

While Cappahayden is within tieback distance of the FPSO, Cambriol — 40 kilometres away — is pushing the limits for a satellite scheme, according to the EIS.

Equinor’s spokesman said: “We will return to the Cappahayden location to finalise drilling operations following the conclusion of the Cambriol well.”

“Results from the wells will be communicated only once the drilling programme has been concluded.”

The base-case project could support up to 20 satellite wells.

The EIS also disclosed that Equinor’s definition of Core Bay du Nord has changed.

In 2018, this nomenclature applied only to the Bay du Nord and Baccalieu discoveries, but now it also includes the Bay de Verde and Bay de Verde East discoveries.

This could partly explain why the number of subsea wells in the project has risen from 30, according to the EIS, to a “conservative” estimate of 40.

This enlarged subsea production system will require an expanded umbilical, riser and flowline system and will be underpinned by up to 10 well templates.

A TechnipFMC presentation this month valued the integrated subsea contract at $500 million to $1 billion.

Up to eight slots in the FPSO turret are due to be used in the Core Bay du Nord scheme, leaving four free for satellite tiebacks.

For both the subsea and FPSO contracts, the winners would carry out front-end engineering and design work before building and installing the offshore equipment.

—

Source: Upstream | This text was excerpted from the media outlet cited on August 28, 2020 and is provided to Noia members for information purposes only. Any opinion expressed therein is neither attributable to nor endorsed by Noia.