The following text was excerpted from the media outlet cited on March 27, 2020 and is provided to Noia members for information purposes only. Any opinion expressed therein is neither attributable to nor endorsed by Noia.

From CBC News

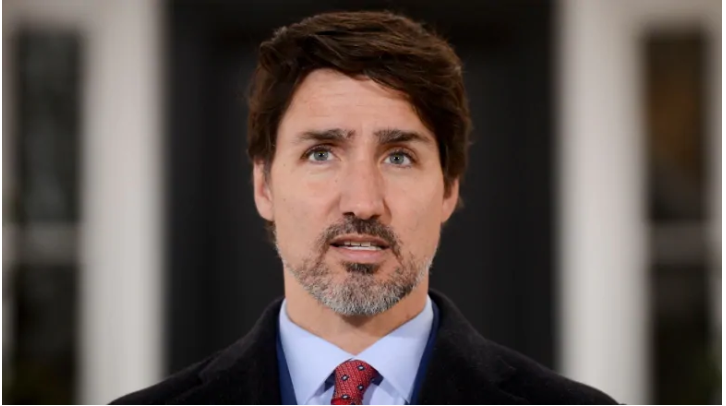

Prime Minister Justin Trudeau announces enhanced measures to keep employees on the payroll

Prime Minister Justin Trudeau today announced more help for small and medium-sized businesses to keep employees on the payroll during the COVID-19 crisis, including a 75 per cent wage subsidy and guaranteed interest-free loans.

During a news conference outside his residence at Rideau Cottage in Ottawa, Trudeau called small and medium-sized businesses the “backbone” of the economy and said the new measures will help them avoid ordering layoffs or closing down because of the climate of uncertainty caused by the pandemic.

“We’re thinking about that family-owned restaurant that’s been around for years, [has] had many of the same employees for years. Employees who’ve been there through slowdowns, good times and bad times, and now in this moment of crisis they’re having to lay these people off at their time of need,” he said.

“We know that allowing people to continue that relationship, allow[ing] people to continue to feel and to know they have a job … is a really important thing, not just for people’s confidence, but for the ability of all us to bounce back strongly from this once we’re through it.”

The prime minister said the wage subsidies will be backdated to March 15, 2020.

The government previously announced a 10 per cent wage subsidy for business. Today, Trudeau acknowledged that was not enough.

At a time when many businesses are losing money, the government will also guarantee bank loans of up to $40,000 for small businesses which will be interest-free for the first year. Trudeau said the program will help businesses “bridge to better times.”

Under certain conditions, up to $10,000 of the loans could be non-repayable.

Trudeau also announced that GST and HST payments, as well as duties and taxes owed on imports, will be deferred until June, which he said amounts to $30 billion in interest-free loans to businesses.

“If you’re struggling to get by right now and you have a payment due at the end of the quarter, we’re going to give you more time. It will also allow you to keep the money that you would have sent to the government and use it instead for your immediate needs,” he said.

Details coming by Monday

Trudeau said details of the programs are still being worked out and that more information will be coming out between now and Monday.

“We’re helping companies keep people on the payroll so that workers are supported and the economy is positioned to recover from this. That is our priority,” he said.

Trudeau could not say precisely how long Canadians will have to stay home and practise physical distancing, but said actions taken now to flatten the curve of infections will help determine how long people remain “stuck” indoors.

“We know we’re talking about weeks and possibly months,” he said.

Giving employees a sense of security

In a separate news conference in Ottawa today, Deputy Prime Minister Chrystia Freeland said that people and companies should not be penalized for doing the “right thing” by staying home unless they’re an essential business or worker.

She said she hopes the measures announced today will help employers to avoid laying off staff, and even to hire back those who already have been laid off. They also will give employees a sense of security in knowing that they still have a job to go back to when the crisis subsides and the economy comes “roaring back,” she added.

The Canadian Federation of Independent Business (CFIB) said that while details are still “scarce,” today’s announcement is welcome news that will help small firms keep hundreds of thousands of workers on the payroll and rehire people.

“Ensuring as many workers as possible remain connected to and paid by their employers will reduce the financial and mental stress on workers and ensure that Canada’s economic recovery will begin the day after the health emergency phase ends,” says a statement from CFIB.

The organization said it’s critical that small businesses get more information about the program quickly — things like who qualifies, whether there is a cap per employee or employer, and whether the subsidy requires the business to pay 100 per cent of regular wages.